This [electronic] version (2015) www.irishpapermoney.com/forum/viewforum.php?f=22 Numismatic Articles and Papers / Occasional Papers on Irish Paper Money

Recommended Citation

Mac Devitt, M. (2015). The ‘Ploughman’ Consolidated Bank Note issue of the Irish Free State, 1929–1941. An analysis of the surviving notes.

[Electronic version]. Accessed [insert date], from irishpapermoney.com/forum/ Occasional Papers on Irish Paper Money:

www. irishpapermoney.com/forum/viewtopic.php?f=22&t=250

The ‘Ploughman’ Consolidated Bank Note issue of the Irish Free State, 1929–1941

An analysis of the surviving notes

By Martan Mac Devitt

An in-depth analysis of the relative rarity of the Irish ‘Ploughman’ Consolidated Bank Note (CBN) series, based on an actual survey of 7.2% of all the surviving notes.

Over the past 15 years a survey of Ploughman notes has been underway in an effort to determine the number of surviving notes potentially available to collectors, and relative rarities of the signatures. The first published (2014) results of the Ploughman Scan Survey (PSS), based on an examination of N=2445 notes are presented here.

Why Consolidated notes?

Prior to Irish independence in 1922 Ireland was part of the United Kingdom. In 1922 Ireland was partitioned into Northern Ireland, which continued to be a part of the UK; and the Irish Free State, which became largely independent. Paper money in Ireland had been provided by six of the nine Joint Stock banks which had the right to issue banknotes which, though not Legal Tender, were exchangeable at par with the British Pound Sterling (Moynihan, 1975). These note issues were stable and had the full confidence of the population. Brennan (1931) notes that a certain amount of English legal tender notes also circulated in Ireland.

Partition of the country led to the question of a currency for use within the Irish Free State. A banking commission chaired by H. Parker Willis of Columbia University, NY, was appointed by the Irish Government to decide on the future of Irish currency. Following the recommendations of the commission in 1927, the Irish Government decided to create a new currency within the state, a Legal Tender Note issue, exchangeable on a par with Sterling and backed by Sterling (Moynihan, 1975), and to also retain the note issues of the joint stock banks operating within the state for a time. The banks’ note issues were to be consolidated into a single uniform design, differing only in the issuing bank’s name, and the key (first) letter of the prefix on the notes, which corresponded to the bank of issue.

Of the extant Old Notes (The Currency Commission term for pre-partition all-Ireland issues) in circulation, the notes apportioned to Northern Ireland (22% of the issues) were to be replaced by a Northern Ireland issue, and notes apportioned to the Irish Free State (78%) were replaced by the new Consolidated Bank Note issue (hereafter referred to as CBN), to be regulated by the Currency Commission. Additionally, the CBN issue was extended to cover the remaining three joint stock banks operating in the state (Hibernian, Royal, Munster & Leinster) which did not previously have the right of note issue. Brennan (1931) notes that the Consolidated Bank Note system was based to a degree on the US Federal Reserve system, a reflection of Parker Willis’ experience as Secretary of the Federal reserve Board, 1914–1918.

The Legal Tender Notes were introduced on 10 September 1928. Shortly thereafter, on 6 May 1929, the extant circulating Old Notes of the banks were withdrawn and the note issues of the banks were split between the Northern Ireland Issue and the Consolidated Bank Note issue.

CBN were printed by Thomas De La Rue Ltd. in London, in denominations of £1, £5, £10, £20, £50, £100. Although designs were prepared for a 10/- note, the denomination was not proceeded with.

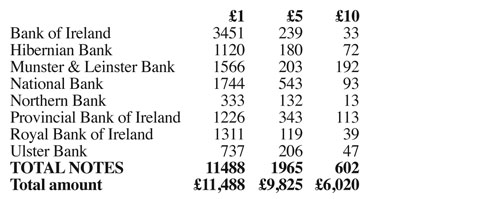

Each bank in the Irish Free State was allocated an amount of CBN in proportion to its size within the state (Table 1). CBN accounted for about 40% of Irish notes in circulation in 1934 (Honohan, 1997). They never reached their total permitted circulation of £6 million, because of the continuing existence in circulation of Old Notes. Joseph Brennan (1931) explains it thus, “The Free State portion of the Old Notes of any bank outstanding at any time is deemed to be Consolidated Bank Notes up to the equivalent of one-half of the bank’s quota of the latter notes.” CBN circulation peaked at over £5,200,000 in 1942 (CBI).

In the event, the CBN proved to be a short-lived issue. A second banking commission, which reported in 1938, recommended the creation of the Central Bank of Ireland to replace the Currency Commission, a transition which was to include the termination of the CBN issue, leaving the Central Bank as the sole issuer of currency in the state. (Central Bank Act, 1942). The CBN issue was finally abolished on 31 December 1956 (Young, 1977; Moynihan, 1975) with each bank paying the amount of its outstanding notes to the Central Bank of Ireland.

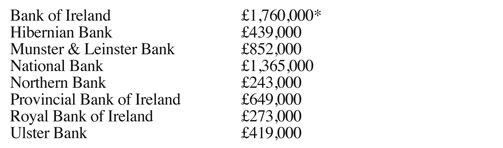

Table 1: The figures for the amount allocated to each of the Associated Banks. Total £6,000,000. (Moynihan, 1974).

*Note, the Bank of Ireland amount includes an allocation of £55,000 to the National Land Bank which was sold to Bank of Ireland in 1926.

Collecting Consolidated notes

Despite its short issue life span, 1929–1941, there is a lot of interest among collectors and numismatists in the CBN. They quickly became known as ‘Ploughman’ notes. There are 8 basic Types, corresponding to the banks of issue, and 19 signature varieties (Table 2), some of which are very rare.

Besides being an important part of the Republic of Ireland banknote issues, they also fall under the category of ‘British Commonwealth notes’ as Ireland was a member during the CBN era, and on up until 1949. Thus, there is a lot to collect and the remaining notes are in high demand and in intermittent supply, though the number of notes available has gradually increased over the past thirty years.

They tend to be relatively expensive. Whilst £1 and £5 notes of each bank are readily obtainable, specific signatures can be much more challenging. Most of the £10 notes are tougher to find, with only the common banks being readily obtainable. Most collections hit a bottleneck at the rarer notes, and a top class collection will still likely be missing a few: Northern £1 and £10, 1929; Provincial £10, 1939. For date collectors, there are a few individual dates which have yet to be recorded (for more details see Consolidated banknotes dates Changelog on irishpapermoney.com).

Table 2: Consolidated Bank Notes (CBN) by Type.

Each signature variation denotes a Type. All notes are also signed by Brennan as Chairman of the Currency Commission.

44 collectible types, plus 4 types printed, never issued (bold italic, marked with asterisk*). All £20, £50, £100 notes were redeemed; Specimens of these denominations are available to collectors.

Only a small percentage of the total issued notes remain in circulation (Table 3). The issued £20, £50, and £100 notes were all redeemed (Mac Devitt, 1999), though examples of issued Munster & Leinster notes exist in the Central Bank of Ireland archives (Mac Devitt, 2005). Thus, only Specimens of these denominations are available to collectors. This leaves £1, £5, and £10 live notes for our collections. A quick calculation reveals that a comprehensive collection, by signature, of CBN amounts to 44 notes, plus 4 unissued types (Table 2).

Given the interest in the CBN over the years, there has been a constant trickle of speculation around just how many of the notes still exist, and are potentially available to collectors. Based on observations and research over the past 15 years, set out here, it is proposed that an accurate estimation of the potential number of remaining CBN can be made.

Ploughman Scan Survey: Data and Method

The dynamic nature of the changing relative rarity of the CBN (Ploughman) notes, and the relatively small number of notes extant, point to the absolute need to determine this rarity from observation alone, relying on the sparse background statistics as a guideline for analysing the results of observation. The goal is to find out what is actually there. This led to the idea of the Ploughman Scan Survey which endeavours to record all the CBN.

Over longer periods of time the discovery of banknotes new to the census of known notes will tend to average out over all of the banks and denominations, to reflect the true relative rarity of each note. Occasionally, there may be a group of one particular banknote, as was the case with National £5 notes where a known hoard of at least 100 notes in sequence has trickled onto the market. The first instance recorded of these notes was on a list of Ivan Maxwell’s in 1982. The latest fresh group of 22 notes surfaced in a show in Dublin in 2011, with other groups turning up in the interim.

The broader rarity of the banks relative to each other has remained generally the same over the past 15 years of the study, for all of the denominations, although notes of the Hibernian Bank have become generally less scarce than they were relative to other banks.

So how do we examine the facts available and come up with an accurate answer? First, we have the statistical information from the Central Bank. Next, we have a pool of known extant notes in collections which we need to take into account when considering the statistical data—that means recording at a lot of notes over a long period of time. This is all we need for estimating relative rarity. The more banknotes we look at, the more robust our conclusions will be, especially in cases where a hoard of similar notes turns up.

It is likely that the only statistics of banknotes outstanding that are relevant to research on relative rarity would be those after around 1980, when every Ploughman note was being kept, rather than only those in better grade as was the case formerly (according to dealers of the 1980s). It can be seen from the 1984 and 1998 CBI figures (Table 3) that the volume of notes turned in over that 14 year period had fallen to a small trickle, at £102 face value. It is also noteworthy that no notes were redeemed between 1998 and 2004, a period which coincides with the growth in popularity of the Irish International Coin shows, at which a lot of CBN have been brought in by members of the public.

Data sources

Not all of the published information is correct. About 20 years ago research started on tracking the lowest and highest numbers of each date after it was noticed that some of the published information contained errors, likely due to mistakes in transcription. It was later decided that the only way to be certain of accuracy was to retain an image of every recorded note, the ‘Ploughman Scan Survey’ (PSS). The survey is continuing, with new data being continuously added from collections and other observation. The intention is to accurately determine the relative rarities of all the notes. The more notes recorded, the more accurate the data set, and any census and analyses based on it.

Ploughman Scan Survey (PSS), 1992–2014, N=2455 banknote images and serial numbers, studying highest and lowest numbers of each date, changes in notes over time, runs of notes in sequence, grades of notes. It includes data from previous work as set out below. This is what the analysis in this article is based on.

ECP, 1992–99, N=862 banknotes recorded. Dates recorded when researching Irish Banknotes (1999). This includes all dates published in Irish Numismatics Magazine (Young D., 1968–83).

GCI, 1977, N=121 banknotes recorded. Date and serial number lists in Guide to the Currency of Ireland, Consolidated Bank Notes (Young D., 1977) which were not also listed in ECP, above.

With well over 2000 individual banknotes recorded so far, and some interesting trends emerging, there is enough data now to carry out some analysis, and to draw some useful conclusions.

Analysis

Over the years, the Central Bank of Ireland provided totals of notes outstanding, see Table 3 for some of these.

Table 3: Consolidated Bank Notes outstanding—Central Bank of Ireland data.

Oct, 1971: £111,895 (GCI, Young, D., 1977, p.11)

Mar, 1972: £110,693 (GCI, Young, D., 1977, p.11)

Aug, 1984: £105,352 (Coin & Medal News, Aug, 1984, Irish Numismatics, Young, D., p. 53)

Dec, 1998: £105,250 (CBIAR, p.65.)

Dec, 2004: £105,250 (CBIAR, p.126.)

The 1984 figure included a breakdown by denomination—a most useful piece of information—as follows:

Remainder, R = 65562 notes with a value of £105,352 (1984).

£1, R1 = 57497 notes = £57,497

£5, R5 = 6559 notes = £32,795

£10, R10 = 1506 notes = £15,060

2004 is the last year where CBN were mentioned specifically in the Central Bank of Ireland Annual Report. By then the total outstanding was £105,250, representing 99.9032% of the 1984 figure. Adjusting the 1984 breakdown to fit the 2004 figure yields the following extrapolated remainder values (Table 4) for each denomination, r, when rounded down to the nearest denominational unit.

Table 4: Extrapolated Remainder, Re = 65497 notes = £105,250 (2004).

£1, re1 = 57440 notes = £57,440 = 87.69867% = 87.70% of the remainder, Re

£5, re5 = 6552 notes = £32,760 = 10.00351% = 10.00% of the remainder, Re

£10, re10 = 1505 notes = £15,050 = 2.29782% = 2.30% of the remainder, Re

Error management in extrapolated remainder

The figures came out with Ten Pounds spread almost evenly between the three denominations, making accurate rounding challenging, considering that one denomination will be rounded at the expense of others. In the case of £10 notes, the actual figure came out at 1,504.54 notes. This was rounded up in accordance with statistical rounding convention, necessitating a rounding down of the number of £5 notes by 0.6502, and £1 notes by 1.34.

First wave of observed data PSS2014 from Ploughman Scan Survey

On 31 December, 2014, the number of observed notes stood at N = 2445 notes = £7,584 = 7.205700% = 7.21% of the total outstanding amount of remainder, R, £105,250. See Table 5. Table 6 shows a Breakdown by bank of known surviving notes. These raw data are presented as is, so that others may draw inferences on their own.

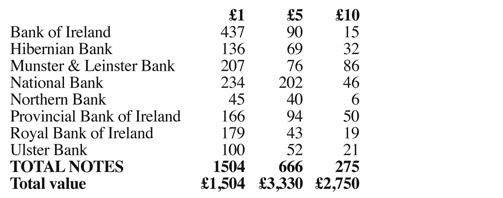

Table 5: PSS2014 Actual recorded notes. N = 2445 notes.

£1, n1 = 1504 notes = £1,504 = 61.51% of N = 2.6183% of extrapolated remainder, re1

£5, n5 = 666 notes = £3,330 = 27.24% of N = 10.1648% of extrapolated remainder, re5

£10, n10 = 275 notes = £2,750 = 11.25% of N = 18.2724% of extrapolated remainder, re10

Table 6: PSS2014 Breakdown by bank of actual recorded notes (7.21% of the outstanding total amount of £105,250). N = 2445 notes (£7,584).

Data Management: Analysing for missing data

In estimating the possible number of banknotes still extant and available to collectors, there are a number of considerations.

First, by means of data mining of PSS data, notes recorded in high grade which are close together in number may be assumed to be out of a sequential run, the gaps in the sequence being treated as being akin to Missing at Random missing data (see Grace-Martin, K., Missing Data Mechanisms, 2001 for discussion), the missing notes may thus be considered to probably exist. Remember, here we are assuming that these notes might exist, not that they do exist. This will form our Extended Data set. There are several such gaps, and the degree of missingness has been estimated conservatively in this study. Additionally, there are in Ireland a few known old collections which have not yet been recorded by serial number in PSS. These are included as missing data.

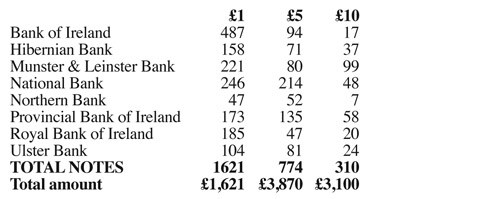

Table 7 presents the extended number of observed notes taking into account missing data banknotes, giving a total extended number of notes, Ne, of 2705 = £8,591 = 8.16% of the total of £105,250 of outstanding amount of CBN. Table 8 presents a breakdown by bank of Ne.

Table7: PSS2014 Extended Data set, Ne: total notes recorded, with missing data added.

£1, ne1 = 1621 notes = £1,621 = 59.93% of Ne = 2.8221% of extrapolated £1 remainder, re1

£5, ne5 = 774 notes = £3,870 = 28.61% of Ne = 11.8132% of extrapolated £5 remainder, re5

£10, ne10 = 310 notes = £3,100 = 11.46% of Ne = 20.5980% of extrapolated £10 remainder, re10

Table 8: PSS2014 Extended Data set, Ne, by bank.

Ne = 2705 notes (£8,591), 8.1625% of the total outstanding amount of £105,250.

Table 9: Comparison of Extrapolated Remainder, Re (Table 4), and Extended Data set, Ne (Table 7).

Notes Outstanding, Re

£1, re1 = 57440 notes = 87.70% of Re

£5, re5 = 6552 notes = 10.00% of Re

£10, re10 = 1505 notes = 2.30% of Re

Notes Recorded, Ne

£1, ne1 = 1621 notes = 59.93% of Ne = 2.8221% of re1

£5, ne5 = 774 notes = 28.61% of Ne = 11.8132% of re5

£10, ne10 = 310 notes = 11.46% of Ne = 20.5980% of re10

A comparison of the Extrapolated Remainder, Re, and the Extended Data set, Ne is presented in Table 9. The percentage of each denomination of Ne, correlates loosely with the percentage of the same denomination of Re, which serves to demonstrate the value of a large dataset. However, there is a wide variance in the percentages of recorded notes between the three denominations. The £1 note record rate is very low at 2.82%,-with £5 and £10 notes being much higher. This result supports the widely held view amongst the collecting community in Ireland over the past twenty years or so that CBN £5 and £10 notes were rather less rare than was reported in the literature, and also reflects the general observed nature of hoards of old notes. This is a significant finding of the Ploughman Scan Survey. The low recorded percentage of 2.82% for £1 notes points to the necessity of collecting more data, especially from smaller note collections containing, for example up to seven £1 notes (excluding the rarer Northern Bank), a few £5 notes, and maybe a £10 note, and collections of World notes with just a few examples of CBN.

Determination of what percentages of notes are likely to have survived

The most important consideration is how to estimate the minimum proportion of the outstanding CBN that are likely to have survived, s, and will be available for collectors. For direction, a look at precedent would seem relevant, at what an Issuing Authority might consider in the circumstances of the retirement of a note issue.

The survival rate of outstanding older notes was already an important issue when the Irish currency was being created (Moynahan, 1974), due to the writing off of dead notes, and government taxation of live note issues. Brennan (1930, as cited by Moynihan, 1974, footnote p162) suggested that only 20% of the pre-1929 Old Note issue outstanding that was more than 20 years old was likely to be eventually presented for payment. By comparison, over 90% of the total Old Note issue was redeemed by 1974 (Moynahan, p162), though there is no information available as to what percentage of this was pre-1910.

The redemption of the Old Note issues was governed by different parameters to those pertaining to the CBN and later note issues. The most obvious difference is the greater purchasing power, approximately 2.5 times (ONS, 2004) of £1 in 1929 relative to that of a CBN £1, post-1960. It could also be argued that with a general increase of living standards as inflation ate into currency value, notes were less likely to be redeemed in 1960 than they were in 1929. The advent of the hobby of banknote collecting around 1970 which provided a demand for obsolete currency would also have had an effect on the remittance rate of obsolete currency notes from then on.

With the introduction of the Euro in 2002, the Central Bank of Ireland amalgamated the totals of outstanding banknotes at 31 Dec 2002 (amounting to €299.7 million) and decided that a provision of €60 million (20%) was appropriate for the amount of this likely to be presented for redemption (CBIAR, 2002, p103). This provision was exhausted during 2010, and a further €10 million was set aside for future redemptions (CBIAR, 2010, p108). A further €10 million was then provided in 2012 (CBIAR, 2012, p137). Thus, the cumulative provision so far is slightly under 26.7%.

With the consideration that some clever financial brains went into the choice of a figure of 20%, followed by a further provision of 6.7% out of necessity, we get an idea of what the modern financial system expects from the redemption of an old note issue. Admittedly, the CBN are much less likely to have survived than the modern notes, however, redemption of the modern notes is far exceeding that of the original provision of 20%.

Next, the nature of hoards of old money should be considered. It has been observed that larger post-WW2, pre-1960 hoards of both Legal Tender Notes and CBN tend to favour £10 notes over lower denominations, while £20 notes, and higher are seldom present, as they were seldom used. This might be due to lower denomination notes being spent preferentially. £10 notes were the main high denomination note in circulation, and thus used for storing money, in a country where wealth was in short supply and relatively few people had bank accounts. Higher denominations than £10 did not circulate in quantity before the inflation of the 1970s, a fact reflected in the printages of the notes. Note, CBN denominations of £20 and higher only ever circulated in tiny quantities, and were almost entirely withdrawn by 1940 (Mac Devitt, 1999). Smaller hoards of notes tend to be pre-WW2 era and have been observed to be more balanced between £5 and £10 notes. Other hoards have been observed to consist entirely of 10 Shilling and £1 notes. The denominations involved tend to reflect the era and location of notes.

The consideration of what kind of model to adopt as a basis for estimating the minimum number of surviving notes of each CBN denomination is made with these thoughts in mind, and points towards choosing an estimation model based on a 30% survival rate of notes for CBN overall, with a weighting towards higher denomination notes, thus: £1, survival rate of 20%; £5, survival rate of 30%; £10, survival rate of 40%. These figures are based on the arguments presented here; the results to date of PSS, with 18.2% of all £10 notes actually recorded by number; the disproportionate numbers of £10 notes in hoards; the 20% rate suggested by Brennan (under slightly different circumstances), and the 26% set aside made so far by the Central Bank of Ireland (also under different circumstances). The results of this estimate are presented in Table 10.

Table 10: Estimate of the numbers of surviving notes for each bank, based on survival rates of 20% for £1 notes, 30% for £5 notes, 40% for £10 notes.

Limitations of the findings of this publication

This study is in its infancy, with PSS2014 being the first publication of results of the Ploughman Scan Survey. In time the number of surviving notes will likely prove to be considerably higher than estimated here, especially for £1 notes, in consideration of the fact that many nonspecialist collections have yet to be recorded, and that the estimations herein have been very conservative. The possibility of a far more accurate picture of outstanding notes and detailed information on grade is there as the survey continues to record more notes. The goal is to record them all, and to make the results available on the web for everyone to study. The accuracy of results should improve, especially if collectors help with the recording process. Readers can participate by submitting notes to the Ploughman Scan Survey PSS census by posting serial numbers, and pictures of their Ploughman notes on the forum, or by email, where they may also follow the continuing progress of PSS.

Further Research

There is wide scope for other aspects of CBN to be researched using Ploughman Scan Survey data.

PSS contains data on CBN Specimen notes, which have been seen in three forms thus far. Images of Specimens may be viewed on the main web site on the Consolidated Banknotes section. An analysis of CBN Specimen notes will be the subject of a subsequent publication in this series.

A side-effect of the PSS dataset is that a good overview of the grades of the extant population of CBN is now available, as well as a census of the notes which have been damaged by cleaning. The survey is also longitudinal to some degree, in that many of the notes recorded have turned up several times in the course of PSS. This will be the subject of future publication.

References

Brennan, J. (1931). The Currency System of the Irish Free State. Journal of the Statistical & Social Inquiry Society of Ireland, Oct. 1931, Session 84, p23–P26.

Bank of Ireland Archives.

Central Bank of Ireland. Abbreviated to CBI in the text.

Central Bank of Ireland, Annual Report, various years as cited in the text. Abbreviated to CBIAR in the text.

Honohan, P. (1997). Currency Board or Central Bank? Lessons from the Irish Pound’s Link with Sterling, 1928-79. BNL Quarterly Review, 200., March, 1997.

Grace-Martin, K. (October 2001) Missing Data Mechanisms, StatNews 46, Cornell Statistical Consulting Unit (Last accessed Oct 2014)].

Mac Devitt, M. (1999). Irish Banknotes. Irish Government Paper Money From 1928. Seachran & Whytes. pp.24–28.

Mac Devitt, M. (2002). Irish Paper Money 1783 - 2001. 1st Edition. Seachran.

Mac Devitt, M. (2009). Irish Banknotes. Irish Government Paper Money From 1928. Updates. Seachran.

Moynihan, M. (1975) Currency and Central Banking in Ireland 1922–60, Gill & MacMillan in association with the Central Bank of Ireland.

O’Donoghue, J., Goulding L., Allen G. (2004). Consumer Price Inflation since 1750, Economic Trends 604. March 2004. ONS — UK Office for National Statistics.

Young, D. (1984). Irish Numismatics, Coin & Medal News, Aug, 1984, p.53.

Young, D., Irish Numismatics Magazine, various issues 1974–1984.

Young, D. (1977). Guide to the Currency of Ireland–Consolidated Bank Notes 1929–1941. Stagecast. Abbreviated to GCI in the text.